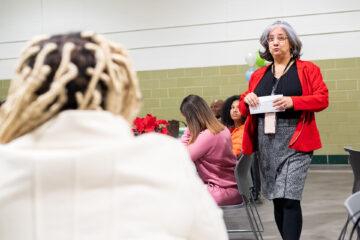

Beyond Housing Adds Experienced Education Leader as Its New Director of Youth and Family Programming

Carrie Henderson will lead the nonprofit’s Network of Children’s Defense Fund Freedom Schools® in partnership with Deaconess Foundation

Carrie Henderson will lead the nonprofit’s Network of Children’s Defense Fund Freedom Schools® in partnership with Deaconess Foundation

How do we build a stronger St. Louis, once and for all?

From teddy bears to affordable homes, investing in our region takes many forms

Beyond Housing launched an extensive improvement project on Stratford Commons along with the majority owner, the Housing Authority of St. Louis County

Beyond Housing works with Missouri Department of Conservation’s Community Forestry Cost Share Program and municipal partners to secure crucial funding for tree-related projects.

Beyond Housing along with several other partners helped create an accessible home for Logan who was severely injured in a car accident before the holidays.

Beyond Housing, The Build-A-Bear Foundation, and the 24:1 Cinema helped spread some holiday cheer with teddy bears and a free movie at Build-A-Bear Day.

Construction has begun on Beyond Housing’s newest project, the Pagedale Town Center Homes Project which is a $12 million project that will create 36

Those who participated in Beyond Housing’s Holiday Friends gift-giving initiative this year got a treat from Build-A-Bear. The Build-A-Bear Foundation donated 800 teddy bears valued

More than 10 percent of the people Homeownership Advisor Ester Alfau-Compas meets with speak Spanish. But until recently, their only option for a homeownership education

Get the latest on our ongoing work

Read the latest news and stories about our work.

From teddy bears to affordable homes, investing in our region takes many forms

Carrie Henderson will lead the nonprofit’s Network of Children’s Defense Fund Freedom Schools® in partnership with Deaconess Foundation

How do we build a stronger St. Louis, once and for all?